What’s Driving Down Linear CPMs?

A common misconception in the advertising world is that linear TV advertising is expensive. While it's true that investing in a Super Bowl ad can cost millions of dollars at a high CPM, the reality is that linear TV CPMs, on average, are significantly lower than streaming or connected TV (CTV). In this blog post, we'll delve into the data and shed light on the market dynamics that are driving down linear CPMs, and how advertisers can take advantage of them.

What the data shows: Linear CPMs vs. Streaming CPMs

Analyzing Tatari client data from 2019 to 2023, we found that streaming CPMs are typically three to four times higher than linear CPMs ($9.50 vs $2.50). It’s important to note here that Tatari's streaming CPMs are already significantly lower than market rates due to our direct deals with publishers (often 66% lower than buying programmatically!). Linear CPMs this year, in particular, have remained low. While one might assume that lower linear CPMs are primarily attributed to smaller, less prominent networks, our internal analysis reveals that even premium networks such as CNN, MSNBC, ESPN, and Discovery often exhibit lower CPMs than their streaming counterparts.

Market dynamics: Budget shifts

So why are linear CPMs low? The first reason is simple: budgets are increasingly shifting from linear to streaming TV. eMarketer even predicts that CTV ad spend will be more than half of linear TV by 2025. However, there are some misperceptions to consider in this shift:

Some advertisers assume that everyone is streaming. This may be more true in densely populated areas. However, the reality is that millions of Americans in rural communities still do not have adequate access to high-speed internet connections.

Some advertisers perceive that streaming TV reaches a more valuable audience, particularly younger viewers. However, this mindset overlooks that older viewers on linear TV often have higher disposable incomes.

Advertisers are also led to believe that targeting audiences in streaming is more accurate, thus justifying higher CPMs. This overlooks the fact though, that linear TV can provide massive reach (more on that later)

We analyzed the number of advertisers on linear TV using smart TV data. The chart below shows that after a COVID bump and growth in 2021 (blue line), there are less linear TV advertisers this year (purple line) compared to 2022 (black line).

In particular, large spenders have been scaling back their investments in linear TV (due to various economic factors), such as the CPG, auto, and pharma verticals, leaving a lot of unsold supply. This is undoubtedly driving linear CPMs down. As an example, using both Smart TV and Tatari data, we analyzed the TV investments of the automobile vertical, a traditionally heavy linear spender. While still spending on linear TV, their spend levels for the past year are well below their historical maximum spending levels.

Such decreased demand has led to lower linear TV CPMs due to the basic principles of supply and demand (think: less demand -> more supply -> lower costs).

Impact of Writer’s + Actor’s Strikes

The ongoing WGA and SAG-AFTRA strikes have further contributed to decreasing linear TV CPMs. In particular, this year's Upfront market looks to be a buyer’s market, where buyers have more negotiating power than ever before. As a result, CPMs in almost every category have decreased, with the exception of live programming (such as sports), which remains unaffected by the strikes.

Uncertainty in the market due to strikes has left advertisers feeling apprehensive, and some believe this may accelerate the shift of ad dollars to streaming TV or other digital platforms.

What this means for advertisers

Less demand can often lead to last-minute discounts (sometimes even more than 90% of rate cards!), often referred to as firesales, on major networks. The number of monthly firesales on broadcast networks has more than tripled since 2022. We’ve even seen firesales for premium opportunities this year, which is rare.

Smart advertisers have a holistic strategy that includes linear and streaming

So there you have it: Linear TV CPMs can be surprisingly affordable (when compared to streaming CPMs). Of course, it’s important to note that premium live opportunities such as awards shows and sports matches may require a higher investment this year, as the ongoing WGA and SAG-AFTRA strikes continue to impact the TV ad market. Advertisers should anticipate increased pricing across all sports and lock in buys as far in advance as possible. Overall though, linear TV currently offers historically low CPMs that we encourage advertisers to take advantage of.

However, that doesn’t mean advertisers should focus only on linear TV and completely ignore streaming. Both linear & streaming should be used in concert for a successful campaign that drives business outcomes.

Reach: Linear TV offers broad reach, allowing brands to connect with a wide audience. However, adding streaming to the media mix can help increase your reach even further and will enable you to hit cord-cutters. Your reach is capped if you are only on linear TV, or vice-versa- if you are only on streaming.

Targeting: On the other hand, streaming TV provides more granular targeting options, enabling brands to reach specific segments based on demographics, interests, or behavior. You can even retarget website visitors on streaming TV.

By leveraging both channels, smart advertisers can make the most of their TV advertising strategy. (See how Manscaped leveraged both linear and streaming TV to increase sales volume by 37%.)

Why you should act now: advertisers are increasing spend in the back half of 2023

It's crucial to act now and take advantage of low linear CPMs, because they may not remain low indefinitely. In fact, we suspect they may become higher in early September. With inflation leveling out, we’ve already seen major brands like P&G and L’Oréal increase their ad investments.

So work with us, take advantage of firesales, and gain access to premium content that would otherwise be too expensive. Reach out to us today!

Vicky Chang

I love helping businesses grow.

Related

How TV Advertisers Should Prepare for a Lengthy Writers’ and Actors’ Strike

As the ongoing WGA and SAG-AFTRA strikes continue to impact the TV ad market, Tatari is planning for all possible outcomes and helping our clients execute high-performing TV campaigns amid the chaos.

Read more

The Missing Piece to Making CTV Retargeting Work: Linear TV

Retargeting has proven to be one of the most successful performance drivers in digital media (namely display ad units). Today, leading marketers are pursuing the same strategy with Connected TV (a.k.a. streaming TV) ads.

Read more

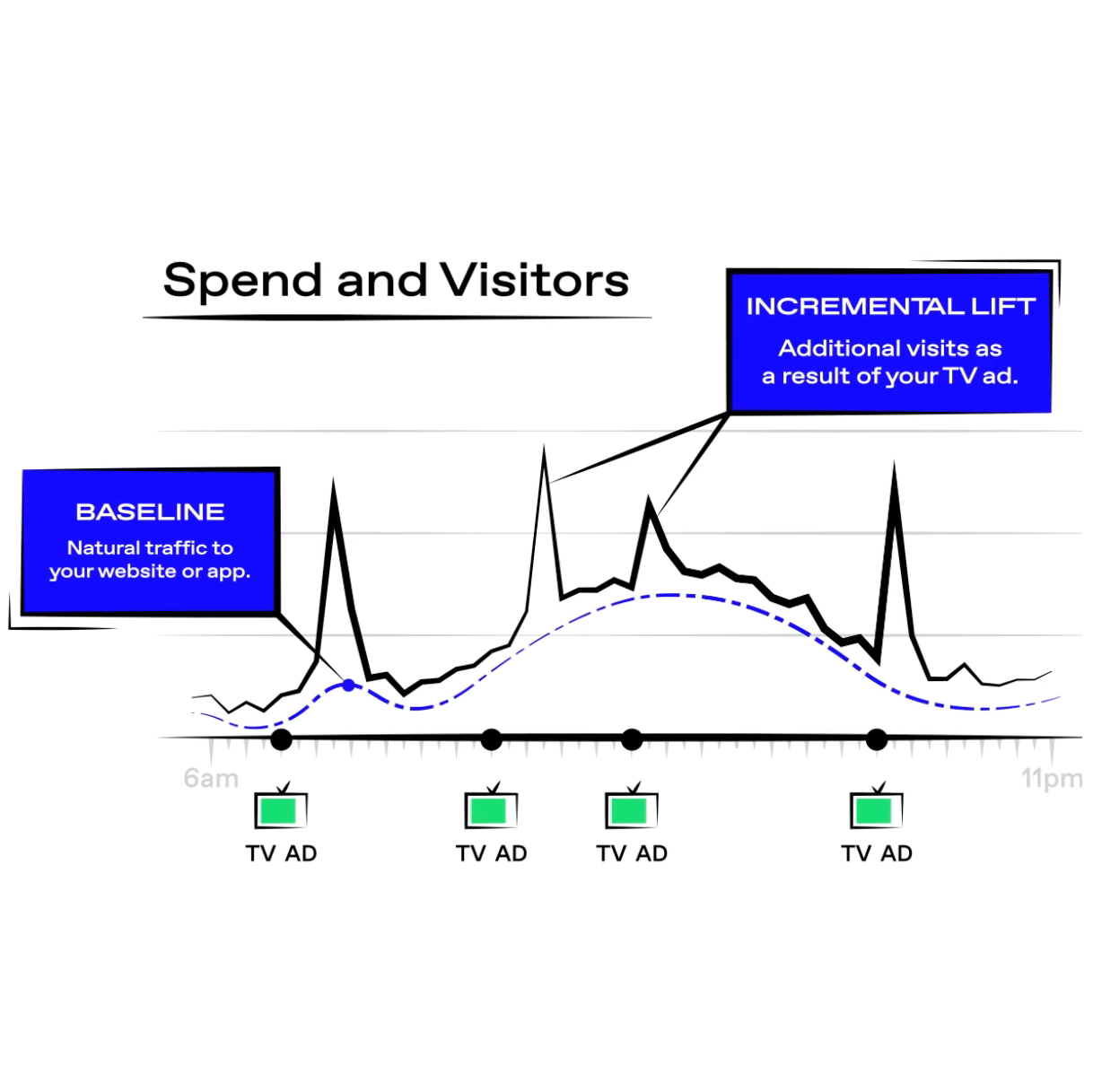

Video: Understanding linear TV measurement

Even though linear TV has been around much longer than streaming, deterministic attribution is typically more difficult. Here is a short video that walks you through our measurement of linear TV.

Read more