Improving TV Advertising With Publisher Tools

This announcement was originally covered by EIN Presswire

As TV viewing is shifting from cable & broadcast to streaming, so is the TV advertising industry. Whilst earlier streaming experiences were subscription based only (e.g. Netflix), AVOD (short for Ad-Supported Video on Demand) may soon overtake subscriptions. Even Amazon Prime Video, initially a subscription only platform, is inserting ads. There is about $70bn/yr in linear TV advertising dollars poised to shift elsewhere, and with AVOD on the rise, there is now room to grow into it (and flourish).

This transition is typically associated with a better process for buying TV advertising, bringing TV on par with digital in terms of speed to market, agility, the ability to optimize, targeting, etc. Programmatic TV advertising is the poster child of these benefits; the reality, however, tells us that the full programmatic activation for AVOD is still a ways off, with programmatic TV budgets hanging at relatively low levels, per eMarketer.

The reasons for this are numerous. On the supply side, many publishers (whether cable, broadcast or pure streaming) do not have the technological infrastructure in place to trade their inventory on exchanges. Wary of the downside risk of inventory commodification and still in an experimental phase with technology, publishers are only making a small fraction of their inventory available for programmatic activation. And when they do, it is often priced 3x higher than the traditional, manual IO (or Insertion Order) ad sales process.

The IO process can be cumbersome for all parties. Each side of the deal must exchange inventory pricing and availability (using Excel spreadsheets), communicate via email (believe it or not, only recently did we outgrow fax and phone), then download, print, sign, and re-upload contracts. A single streaming media buy can easily explode into 100 emails over 4-5 days. For all intents and purposes, it regresses streaming TV media buying to the linear process. Worse, the scalability of AVOD (in the short term at least) relies on how effectively and efficiently AVOD networks can grow via direct sales.

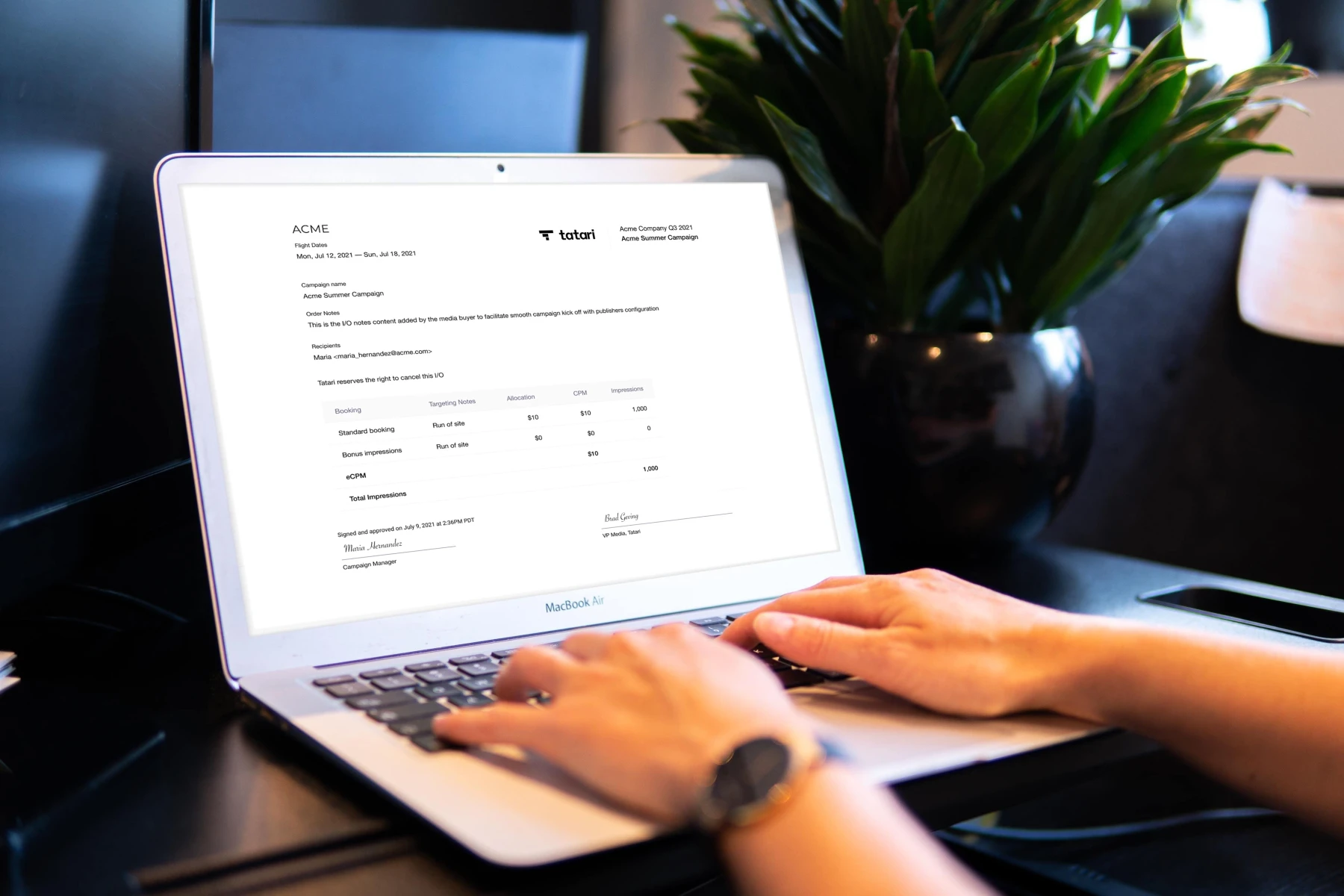

To give advertisers – high-growth digital-native DTC brands in particular – what they want (speed, transparency, agility, optimization), Tatari rewrote the playbook on the IO process last year. Without asking or expecting publishers to ditch familiar IO sales, we have rescripted the process and moved it online. Orders are automatically pulled out of media plans and electronically shared with sales reps. Any changes, revisions, or cancellations are tracked in the cloud, and presented via a cohesive web interface (screenshot below). Orders and subsequent order revisions are signed electronically by both parties so that lawyers can sleep well, too. The same streaming buy mentioned above can now be executed with a single email(!) and <1hr turnaround time. This is a huge time saver for buyers and publishers alike. Scott Berger, VP of Direct to Scale at NBCUniversal Advertising and Partnerships, said: “At NBCUniversal, we pride ourselves on making it as simple and easy to buy premium video content as it is to watch it. Tatari’s technology has had an extremely positive impact on how we process direct insertion orders, streamlining the process and enabling us to prove out the efficacy of the NBCU audience for our DTC partners."

Rest assured, this step-change improvement isn’t confined to streaming publishers; Tatari has now automated the linear (or cable & broadcast) order process, too.

It doesn't stop there. Some of our network partners are programmatically parsing Tatari traffic instructions and piping them directly into their legacy ad trafficking systems. In turn, Tatari is writing software to help publishers manage their inventory with Tatari. For example, if we can demonstrate that a particular show or program drives stronger performance and unlocks more media volume, the network or publisher can make the intelligent decision to offer this (or not).

None of the above, however, means we are not believers in programmatic. Like everybody else, Tatari is yearning (and ready!) for the day we can transact all inventory, linear and streaming, programmatically. Our clients shouldn’t have to wait for that day to move fast and scale quickly, and the technology explained above allows us to bridge the gap. Tatari is a demand-side company, and we make it work in today’s reality by not shying away from building supply-side tools.

Philip Inghelbrecht

I'm CEO at Tatari. I love getting things done.

Related

Post-Upfronts, Agencies Need to Look Differently at Linear-Streaming Convergence

With more networks offering OTT inventory as a part of their linear upfront packages, it's increasingly important for brands to use a holistic measurement approach to assess performance across streaming and linear TV.

Read more

Celebrating Partnerships and Inspiring Action at Tatari's Network Party

Tatari's 2021 network party brought together over 100 of our valued partners from leading networks and publishers and delivered one part celebration, one part innovation, and one part inspiration.

Read more

How 4 DTC Disruptors Use Digital Best Practices to Succeed on TV

We partnered with Adweek to look at how four top DTC brands—Roman, Made In, Ibotta and Rothy’s—are using a data-driven approach to drive performance with TV advertising.

Read more